Investing Systematically

According to the latest statistics released by the Hong Kong Monetary Authority, the total deposits with authorized institutions in Hong Kong amounted to more than 15 trillion Hong Kong dollars in November 2021. Stephanie Leung, StashAway’s Group Deputy Chief Investment Officer and Head of the Hong Kong office, thinks people here save too much and invest too little.

“I personally just keep three months worth of pay as an emergency fund in banks and invest all the rest I have.” She sees the huge amount of savings as a large potential for wealth management."

Stephanie Leung, StashAway’s Group Deputy Chief Investment Officer and Head of the Hong Kong office

Pioneering Digital Wealth Manager

Leung has more than 17 years of experience in global portfolio management for Goldman Sachs, institutional investors and family offices, and has managed multi-asset and multi-billion dollar portfolios. Her work experience in finance and academic background of computer science (she holds a Bachelor of Computer Engineering from the University of Michigan and a Masters in Computer Science majoring in Artificial Intelligence from Stanford University) make her a natural match for StashAway, a digital wealth manager from Singapore.

At StashAway, the majority of investment decisions are made by algorithms, according to the Modern Portfolio Theory’s Efficient Frontier. “It is basically mathematics,” Leung explains. “Everyone can easily download the formula and do the calculations with Excel spreadsheets. However, you will need to know what the right data to put in.”

Data-driven Investment Decisions Making

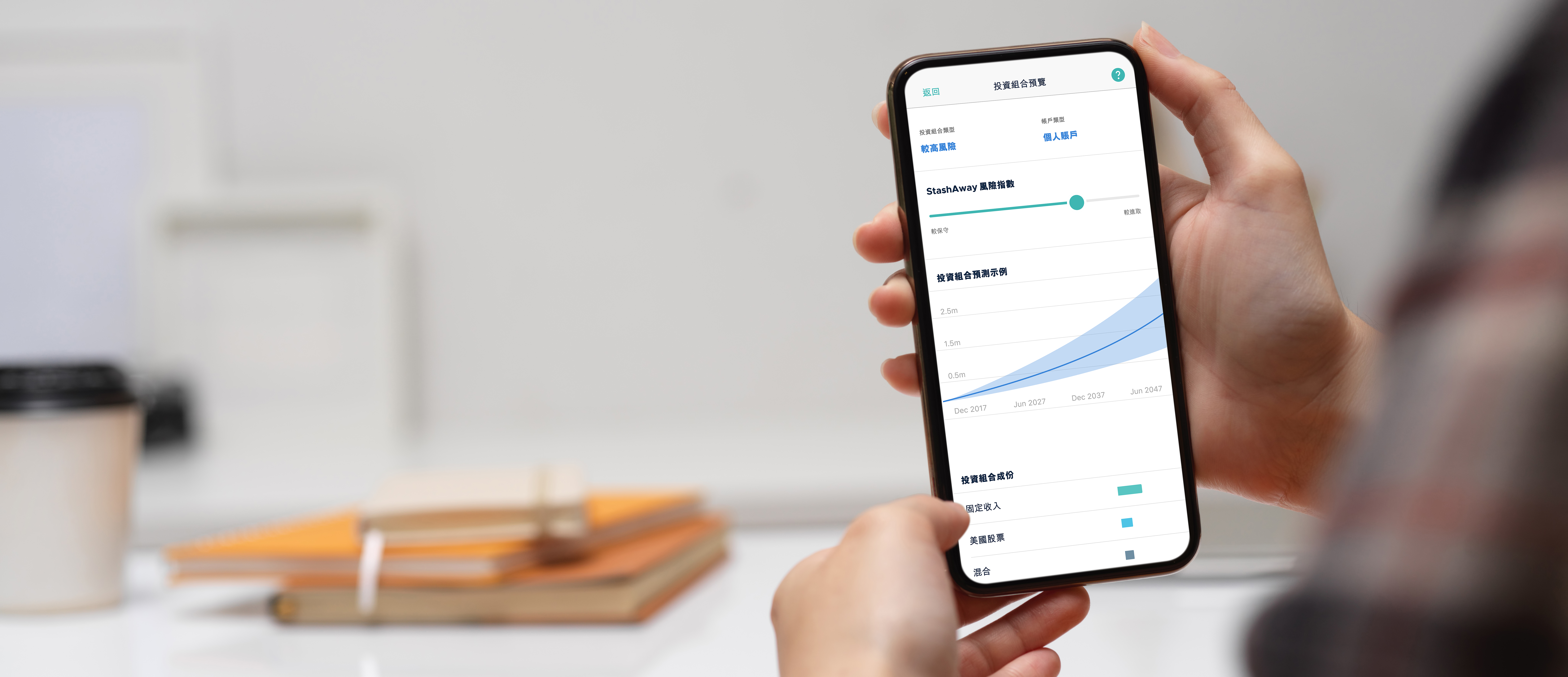

The data that StashAway input in the formula are mainly economic data, and the algorithms will then recommend 7-10 different types of asset classes, come up with a list of more than 50 exchange traded funds (ETFs), and put together an optimal, diversified portfolio, or a thematic portfolio of an investor’s choice. The combination of ETFs will change with varying economic data, meaning that it will be adjusted according to the economic environment.

“Hong Kong people invest too little. Even those who do usually just invest in a few stocks, funds or insurance products. They do not have a systematic way to make investment decisions, nor do they adjust agilely to economic conditions,” Leung observes.

The Path to FIRE

She admits that it is difficult for amateurs to select which sectors and what assets to invest in. That is why StashAway launched their platform in Hong Kong to make access to institutional way of investing easy and cost-efficient for everyone so that people can start investing and marching towards FIRE (Financial Independence, Retire Early).

To achieve FIRE, a person will have to maximize savings and minimize expenses, along with sufficient investments to grow his/her wealth. The objective is to accumulate assets until these assets can generate enough amount of passive income to support the daily expenses throughout one's retired life. Upon reaching financial independence, paid work becomes optional, allowing the person to take full control of his/her time and pursue something that he/she really enjoys.

“Most of the time when you ask people why they work, they will tell you that they work for money,” Leung elaborates. “To me, FIRE means that I can freely choose to spend my time on something that makes me happy. In fact, I love working. I would still love to go to work even when I achieve financial independence, as long as I am happy with my job. It is a matter of choice, and whether you choose to work or are forced to work. Life is short and everyone of us would want to live a happy life.”

Know Your Money

The first step towards FIRE is, in Leung’s opinion, to “know how much money you have, how much risks you are willing to take, and how to allocate and invest your money.” She is keen to spend more efforts in investor education. Indeed, StashAway has developed its own education curriculum. “People do not invest because they do not know what to invest, and they are scared of losing money. Investor education is therefore very important.” StashAway clients can access the financial planning and investment courses on its app, free of charge.

While it is a fintech company, Leung says they do not underrate human touch. “A friend of mine once praised our chatbot and I surprised her that it was not a chatbot, that was a real customer service professional,” she jokes. “We rely on computer science and algorithms to manage wealth. We automate many investment processes. Yet we acknowledge that human interactions are crucial in building trust with our clients. We not only have a customer service team, but also a team of wealth management professionals who leverage technologies to provide even better solutions and services to our clients.”

Disruptions Create Opportunities

Technologies, in Leung’s opinion, will for sure overturn the financial industry in the not too distant future. “Blockchain has disrupted a lot of industries, and the most significant disruption will happen in the financial industry due to decentralization and the cut out of third-party validation,” she predicts. “Yet, disruptions create opportunities. We are now at the early stage of the adoption curve. The blockchain and crypto development could drive explosive growth and we should be well prepared to capture the opportunities.”