Legal entities established in the British Virgin Islands (“BVI”) and the Cayman Islands need to comply with Economic Substance related regulations which were introduced since January 2019.

Economic Substance requirements remain important in the BVI and Cayman Islands

The Economic Substance (“ES”) requirements applicable to legal entities established in both the BVI and the Cayman Islands have continued to be amended after inception. Brought into force to comply with and newer European Union (“EU”) directives in 2019, the ES requirements, coupled with laws such as the Private Fund Law in the Cayman, aim to increase transparency of funds and enable the two jurisdictions to continue to be attractive for offshore fund management. Under the ES regulations, legal entities conducting relevant activities in each financial period have to observe various required requirements within the defined deadline. Those requirements include ES classification and reporting.

Regulatory Updates for the BVI: Economic Substance Reporting

As per the Economic Substance (Companies and Limited Partnerships) Act, 2018 and the subsequently issued rules on ES in the BVI, any firm that is a Legal Entity conducting a Relevant Activity during any Financial Period must comply Economic Substance requirements. As per the Act, relevant activities include banking business, insurance business, fund management business, finance and leasing business, headquarters business, shipping business, distribution and service centre business, intellectual property business and holding business.

The ES Act requires relevant activity to be directed and managed in the BVI and have the legal entity conduct core income generating activity in the BVI. In addition, legal entities must have regard to the nature and scale of the relevant activity demonstrated through adequate number of suitably qualified employees physically present in the BVI, adequate expenditure incurred in the BVI and having physical offices in the BVI appropriate for the core income generating activities.

Failure to comply will lead to heavy penalties for both legal entities as well as for individuals, ranging from US $5,000 to US $400,000 for legal entities and up to US $75,000 for individuals. Legal entities who fail to comply after 2nd determination will be struck off, while a person who fails to provide information, or providing false or misleading information may need to pay the fine and face imprisonment of up to 5 years on conviction on indictment.

Economic Substance Reporting Deadlines

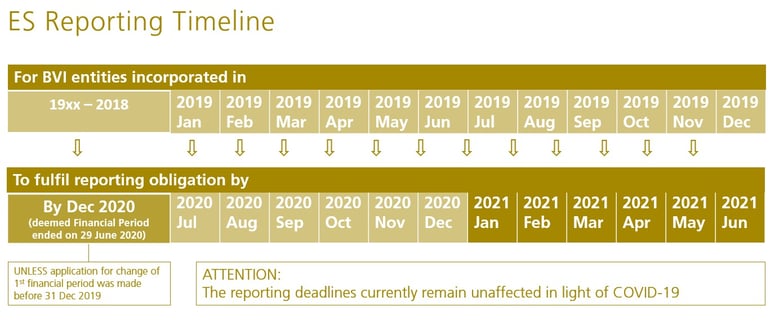

Whether a legal entity is required to comply with the economic substance requirements depends on whether it has carried on a relevant activity during a financial period. All BVI entities will be required to make necessary reporting by submitting information to the BOSS system through its registered agent within 6 months after the end of each financial period.

Legal entities should have classified their relevant activities by now and be ready for reporting. These deadlines remain unchanged in light of COVID-19 and we have further illustrated this in the timeline below:

Regulatory Updates for the Cayman: Private Fund Law comes into Force

With the Cayman Islands’ Government published the Private Funds Law (“PFL”), 2020 on 7 February 2020 to bringing most close ended firms under the Cayman regulatory oversight and require to be registered with the Cayman Islands Monetary Authority (“CIMA”) before 7 August 2020. This Law applies to a private fund that is carrying on business or attempting to carry on business in or from the Islands but does not apply to a regulated mutual fund or a regulated EU Connected Fund. In addition, the Mutual Funds (Amendment) Law 2020 was enacted to amend the Mutual Funds Law (2020 Revision) to enhance the regulatory and supervisory framework for mutual finds. The MFLA was enacted to bring most open-ended funds under regulatory oversight and require them to be registered with CIMA.

On 9 July 2020, the Cayman Islands further amended the PFL to clarify the definition of Private Fund. As per the amendment, Private fund law now cover any company, unit trust or partnership that offer or issue or have issued investment interests, the purpose or effect of which is the pooling of investor funds enabling investors to receive profits or gains from such entity’s acquisition, holding, management or disposal of investments, where:

- the holders of investment interests do not have day-to-day control over the acquisition, holding, management or disposal of the investments; and

- the investments are managed by or on behalf of the fund's operator of the private fund, directly or indirectly.

However, the definition of Private funds do not include:

- a person licensed under the Banks and Trust Companies Law (2020 Revision) or the Insurance Law 2010;

- a person registered under the Building Societies Law (2020 Revision) or the Friendly Societies Law (1998 Revision); or

- any non-fund arrangements.

Among other regulatory updates, the Government has updated the beneficial ownership regime. A beneficial owner under the Companies Law and the Limited Liability Companies Law is defined as persons who directly or indirectly hold 25% or more of the shares or voting rights in a company. Secondly, the a definition of a company is now updated such that it is considered a "subsidiary" of an entity or entities if such entity/ies, separately or collectively, hold 75% or more of the shares or voting rights in the underlying company. In addition, the Administrative fines regime based on The Monetary Authority (Administrative Fines) (Amendment) Regulations, 2020, was brought in force in June 2020. There is an extension on the fines based on provisions from a wide-ranging set of rules regulations and laws for companies that breach updated beneficial ownership provisions.

Readiness and Planning is Vital

With the implementation of the ES requirements, legal entities should ensure that they act swiftly and are compliant with the latest regulatory requirements. Tricor’s experienced professionals across the BVI and Cayman jurisdictions can advise and assist you to enable compliance with the ES regulations, while providing robust support for your existing operations. For immediate ES reporting and compliance needs, we can assist you to do classification, documenting the Board decisions and to create or outsource ES requirements. We can help you in finding other possible solutions including incorporation of new entities in the UK, Hong Kong or Singapore and for group restructuring, where required.